E-invoicing and automated processes become more and more important for Financial Accounting, which is in particular due to the current statutory regulations. However, companies should not consider e-invoicing as a mere fulfillment of legal requirements. Electronic processing offers enormous opportunities for automated invoice processes and for increasing their transparency.

You can use the SAP FIS/eInvoicing optimization to quickly and digitally process your inbound and outbound invoices directly in SAP. The software application supports you in exchanging structured electronic invoices when communicating with authorities and business partners.

Understand automation and digitization as an opportunity

Manually complicated tasks in finance and accounting are processed efficiently and sustainably through electronic business processes. Invoices are not sent analogously by mail or fax and passed on through the departments but transferred and processed as digital documents in structured form. Paperless communication enables you to accelerate processing times and use cash discounts, for instance, more effectively. Moreover, you avoid input errors that might occur when manually entering invoice data. Any required information is always available and transferred correctly.

Your benefits from e-invoicing with FIS

- Cost savings and sustainability: savings of up to 80 % compared with the paper-based invoice process, e.g. by saving administration and postage costs

- Higher cash discounts received and improved liquidity: long dispatch routes are avoided, invoices are paid more rapidly

- Time saving through automated processes: quick processing of mass data, reduced processing times of SAP invoices

- High data quality: avoidance of manual input errors, real-time availability of data in the ERP system

- Fully integrated end-to-end processes: automated triggering of subsequent activities, e.g. release or payment

- Increased process transparency: all information is available in the SAP system, overview of each current invoice status

- Fulfillment of legal requirements: compliance requirements, automated meeting of deadlines (e.g. retention period and deletion time limit)

- Implementation of international invoice standards: XRechnung, ZUGFeRD, Factur-X, FatturaPA etc. · Consistent financial process between all involved: a clear user interface for all invoice formats and communication paths – also for PDF invoices

DOWNLOADS

E-Invoicing – Intelligent invoicing processes with SAP

Digital Invoice Processing WITH FIS/InvoiceManagement AND DRC

FIS/InvoiceManagement and Document and Reporting Compliance (DRC) by SAP enable uncomplicated creation, fully automated transmission and reception as well as automated processing of inbound electronic invoices.

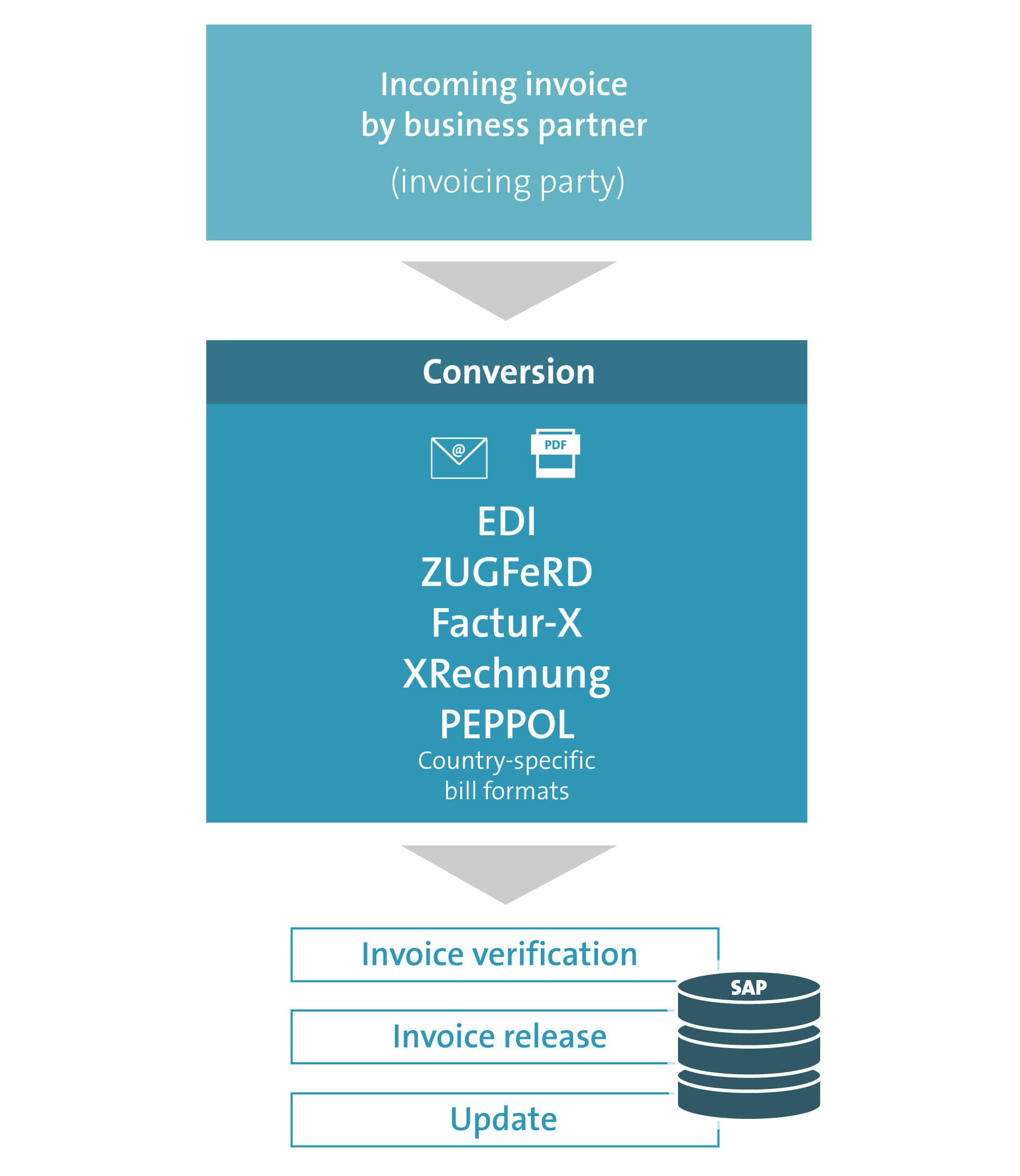

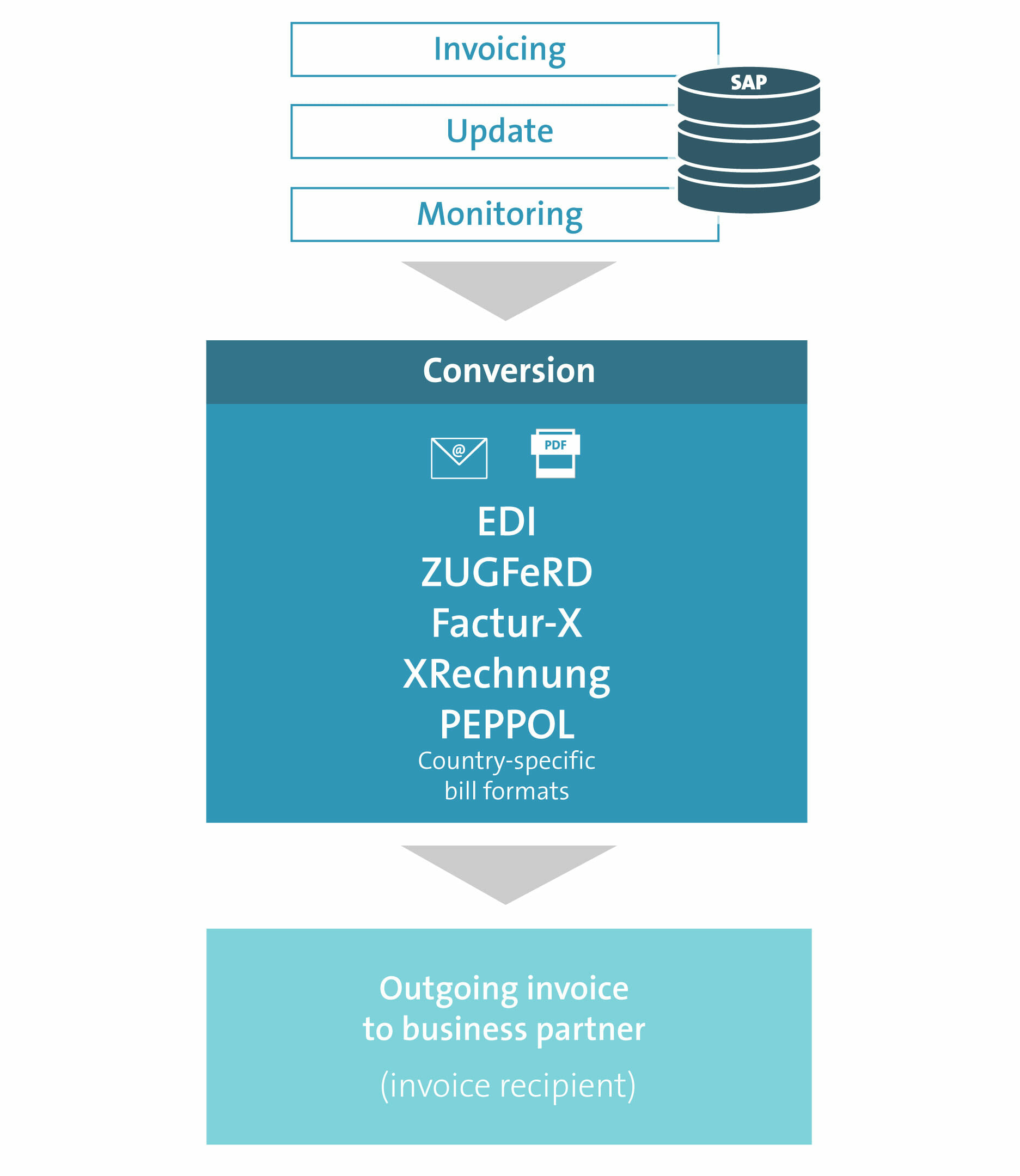

No matter the format and the transfer method: classical EDI (Electronic Data Interchange), invoice formats such as XRechnung, Factur-X, ZUGFeRD and InvoicePA/FatturaPA or the communication via e-mail or PEPPOL platform. Even paper invoices can be processed: The OCR recognition software by FIS digitizes the relevant data and translates it into the required format.

Using the FIS software solution, individual requirements can be taken into account and implemented in the system. Seamless integration into the SAP standard processes is possible as well. In addition, the invoice process can be further automated by AI & machine learning. FI invoices, for instance, are independently classified and assigned to an account, the responsible approver is identified and the release process triggered.

For invoice receipt, the SAP DRC solution covers a large number of country-specific invoice formats and processes. Therefore, the solution can optimally be used for inbound invoices from different countries. FIS/InvoiceManagement includes a solution used for the receipt of domestic invoice formats. This solution particularly specializes in German standards and provisions and is able to map them cost-effectively. All inbound invoices are centrally and automatically processed in one application or forwarded to the accounting clerk if required.

Both solutions can also be used in combination for outbound invoices. Here as well, SAP DRC provides a large number of country-specific invoice formats. FIS/InvoiceManagement, however, specializes in domestic standards and provisions. Depending on the invoice recipient, a suitable format and possible legal processes of the respective country can be mapped. In this way, the benefits of both solutions are ideally combined.

Digital Processing of Incoming Invoices – procure-to-pay process

Automated Invoicing – Order-To-Cash Process

Frequently asked questions on e-invoicing

Interested in E-Invoicing with SAP? Request personal consulting

Request now for E-Invoicing with SAP – free of charge and without any obligation!

You are currently viewing a placeholder content from HubSpot. To access the actual content, click the button below. Please note that doing so will share data with third-party providers.

More InformationMore process efficiency with SAP optimizations by FIS

Downloads

Make a changeover to SAP E-Invoicing for the electronic processing of your invoices. SAP and the complemental FIS optimizations enable you to fully automate your invoice processes and find orientation in the labyrinth of X & e-invoice, PEPPOL & Co. Please do not hesitate to contact the SAP experts of FIS for further information via e-mail or phone.